In 1992 under the Keating Labor Government the compulsory employer contribution scheme became a part of a wider reform package addressing Australias retirement income dilemma. It is advisable that all employers in Malaysia remain aware of the upcoming public holiday dates.

Sage Ubs Software Ubs Update Payroll Epf Statutory Contribution Rate Setup Effective On August 2013

Employers can now easily access all the forms you need when it comes to registration updates and also contribution in one central location.

. KWSP 7 Borang E Schedule of Contributions Arrears. The amount is calculated based on the monthly wages of an employee. We provide government reports like.

Access to internet banking makes EPF contribution payments much easier now. KWSP EPF Contribution Rates. Since 2020 the default.

Effective from April 2020 salarywage up to December. And then increase by 05 each. The contribution rate increased over time.

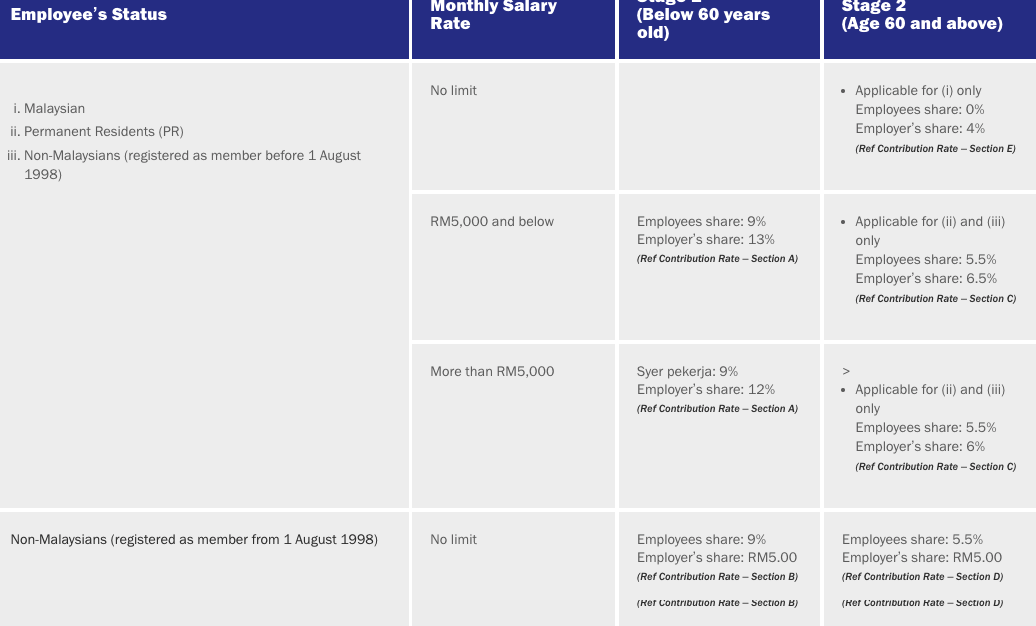

Credit bank report cheque listing contribution info listing and HRDF report Need a government report. EPF contribution rate shown in the EPF table does not apply to foreigners registered as EPF members before August 1 1998. Registration Updates.

The current contribution rate is in accordance with wagesalary received. SQL Payroll is compliant to all Malaysian statutory bodies like KWSP LHDN and SOCSO. EPF Borang A.

In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. The SG rate was 95 on 1 July 2014 and was supposed to increase to 10 on 1 July 2018. The Prime Ministers Department in Malaysia has announced the dates of the upcoming public holidays in Malaysia.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. This ensures the better management of manpower and smooth operational transitions. YOUR ONE-STOP EMPLOYER FACILITY.

If you are interested to know the calculation of the EPF contribution formula you have came to the right place. Our system saves you the trouble by auto calculating EPF SOCSO EIS HRDF and PCB contribution. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule.

The monthly wages of Malaysians aged 60 and over and non-Malaysians of any age do not affect the employers EPF contribution rate. Get the right form you need right here. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000.

Employers EPF contribution rate Employees EPF contribution rate Monthly salary rate RM5000 and below More than RM5000 RM5000 and below More than RM5000 Malaysian age 60 and above 4 0 Malaysian below age 60 13 12 9 Permanent resident below age 60 13 12 9 Permanent resident age 60 and above 65 6 55. Public Holidays in Malaysia for 2023.

How To Calculate Epf Bonus If Employee S Wages Less Than 5k But Bonus Wages More Than 5k Qne Software Sdn Bhd

Sage Ubs Software Ubs Update Payroll Epf Statutory Contribution Rate Setup Effective On August 2013

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Time Value Of Money Computing The Retirement Fund In Epf Account Of An Employee Kclau Com

Do Expatriates Need To Make Payments To The Epf In Malaysia Althr Blog

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Contribution Rates 1952 2009 Download Table

32 Kwsp Contribution Rate 2020 For Age 60 Png Kwspblogs

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Employee Epf Contribution Rate Sql Account Estream Hq Facebook

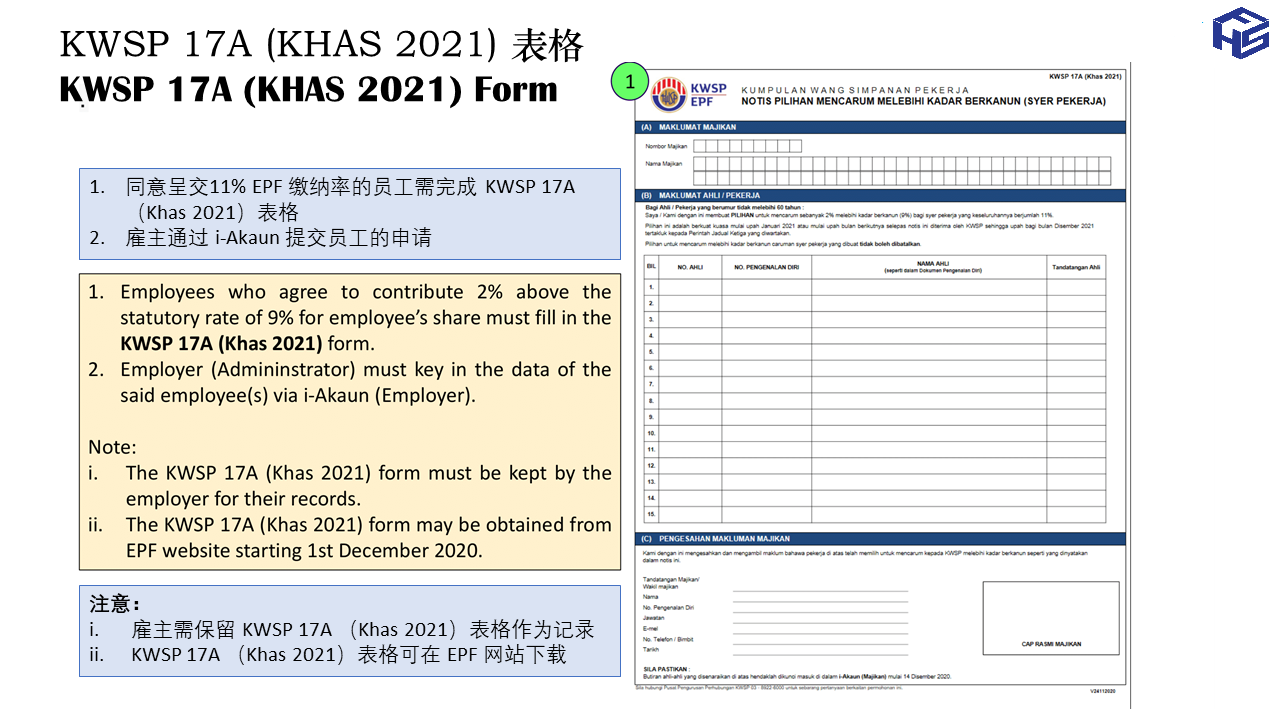

Epf Contribution At 11 Causes Confusion For Employers Here S A Quick Guide

Employee S Epf Rate From 11 To 9

Download Employee Kwsp Contribution Pics Kwspblogs

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Change Of Contribution Table Ideal Count Solution Facebook

Download Kwsp Rate 2020 Table Background Kwspblogs

Epf Contribution Table 2021 How To Calculate Your And Your Employera S Epf Contribution

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird